No products in the cart.

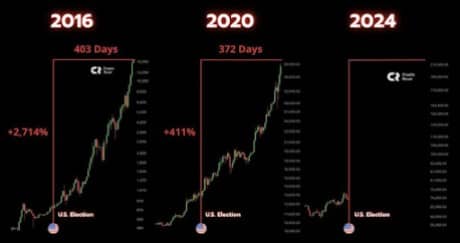

How to Build an Asset Class in Three Easy Steps

Kelly Ye, portfolio manager at Decentral Park Capital and Andy Baehr, head of product at CoinDesk Indices, trade views, active manager vs indexer, on what steps are most important to shape the capital markets and investment landscape for digital assets in a post U.S. election world. Source link

AI is a tool like the paintbrush – it can be used for good things and terrible things

Conceptual artist Phillip Toledano argues that AI is like a paintbrush or Photoshop – and to fight against it is to fight against the sea. Source link

Aggregation Is the Only Way to Unify Web3

Blockchains are stuck in silos, fragmenting liquidity and making for a clunky user experience. It’s time to tear down the walls. Source link

Breaking Down Information Silos in Web3 With AI

Applied to information silos in Web3, we could conceive a tool that pulls together information from various blockchains, dApps, and exchanges into a single interface. And, taking that interface one step further, why not prompt such an AI aggregator to use this data to provide actionable insights to users? Source link

Reducing Risk and Enhancing Liquidity in Crypto Markets

The cryptocurrency and decentralized finance (DeFi) ecosystems currently lack access to stable, high-quality collateral besides stablecoin. Crypto and DeFi traders typically rely on volatile assets like bitcoin or ether as collateral for loans, staking, and liquidity pools. While effective, this system introduces significant risks, as the value of these assets can fluctuate wildly within…

How a Small Crypto Allocation Can Diversify Portfolios and Improve Risk-Adjusted Returns

Crypto markets have shown explosive growth, far outpacing traditional asset classes in terms of returns. For example, bitcoin has delivered an annualized return of 230% over the past decade, compared to the S&P 500’s annualized return of around 11%. Ether, another dominant cryptocurrency, has also offered triple-digit annual growth rates in its early years.…

The Fed Is the Wrong Regulator for Stablecoins

First, and perhaps foremost, the Fed would be conflicted. As an alternative payment service, stablecoins compete with the Fed’s own payment infrastructure, including FedNow, the central bank’s instant payment service. The Fed’s consideration of a central bank digital currency would leave it further conflicted when regulating privately issued stablecoins, as those two digital representations…