No products in the cart.

Crypto Markets Surge on Election Night

As investors responded to expectations that Donald Trump would take the US presidential election, crypto markets saw a notable increase Tuesday night. Due to this knowledge, the cost of Bitcoin rapidly increased and hit an all-time high of about $75,000. Bitcoin previously peaked in March at $73,000, but the ongoing election-related anxiety has caused it to trade below that level recently. The sharp increase demonstrates how political events can have a significant impact on crypto valuations, particularly when laws and regulations are changing.

Source: CoinMarketCap

Throughout the summer, Trump along with the Republican Party publicly endorsed crypto, with strong industry support. This funding was provided following years of industry dissatisfaction with the Biden administration’s restrictive policies. The regulatory framework under the Democrats, according to many crypto creators and investors, hindered innovation and industry expansion. As Trump and the Republicans have taken a more pro-crypto posture, industry participants have come together in the hopes that the incoming government will relax rules and create an environment that is more encouraging for crypto endeavors.

As Bitcoin gained popularity, crypto advocates celebrated on social media.With Democrat Gary Gensler as its chairman, most people anticipated that the Securities and Exchange Commission (SEC) would shortly undergo a shift. Gensler is a contentious figure in the bitcoin space because he has been accused by a number of executives of limiting expansion through burdensome rules. A possible shift in the SEC’s leadership may herald a new era for the cryptocurrency industry, bringing with it regulations that promote expansion and loosen limits on digital assets. The possibility of Gensler’s resignation gives cryptocurrency fans even more cause for optimism.

In addition to the presidential contest, pro-crypto Republican Bernie Moreno won an Ohio Senate seat over Democratic incumbent Sherrod Brown. Because of Moreno’s ardent support for digital assets, the crypto industry donated tens of millions to his campaign. Brown had previously served as the chair of the influential Senate Banking Committee and was well-known for his anti-crypto views. His loss makes it quite evident that American politics’ stance on cryptocurrency is changing. With Moreno’s victory, the cryptocurrency sector has gained another congressional buddy that is likely to support policies that benefit the sector and shield it from laws that would restrict it.

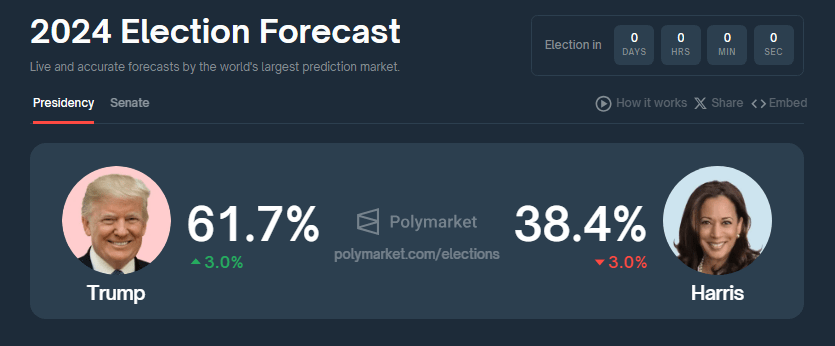

Additionally, as Trump’s prospects seemed to increase throughout election night, Polymarket, a cryptocurrency-based prediction market, received validation. In the weeks preceding election day, the platform had continuously predicted a Republican victory. Polymarket had a 58% prediction of a Trump win at the beginning of election day, but as the results came in, that percentage jumped to 90%. Polymarket’s prediction of the election’s result demonstrates the promise of blockchain-based forecasting markets. For many, it emphasizes how decentralized platforms may be used to monitor election patterns and public opinion.

Numerous other cryptocurrencies saw increases once the results came in. The second-largest crypto, Ethereum, increased by almost 7%, and the third-largest, Solana, increased by roughly 15%. The novelty crypto Dogecoin experienced the largest increase, increasing by over 20%. Elon Musk, a tech tycoon and longtime supporter of Dogecoin, is mostly to blame for this abrupt rise. Musk recently made the amusing remark that a Trump government would establish a Department of Government Efficiency, or “DOGE.” The election’s pro-crypto sentiment and this amusing remark increased Dogecoin’s value and strengthened Musk’s hold on its appeal.